New technologies have revolutionised the way of working in companies. This evolution includes the Finance Function 4.0 and the digitisation and automation of processes.

According to Accenture’s 2021 CFO Now report , 60% of business finance tasks are currently automated, compared to only 34% in 2018.

Implementing Finance Function 4.0 in companies entails profound changes in their finance departments but also enormous advantages.

Index:

- What is Finance Function 4.0?

- The CFO’s active role in Finance Function 4.0

- How a company’s CFO can help Finance Function 4.0

- The 4 advantages of Finance Function 4.0 for business

- How to achieve Finance Function 4.0

- Yeeply helps companies achieve Transformation 4.0

[ sc name=”bt-digitalization”]

What is Finance Function 4.0?

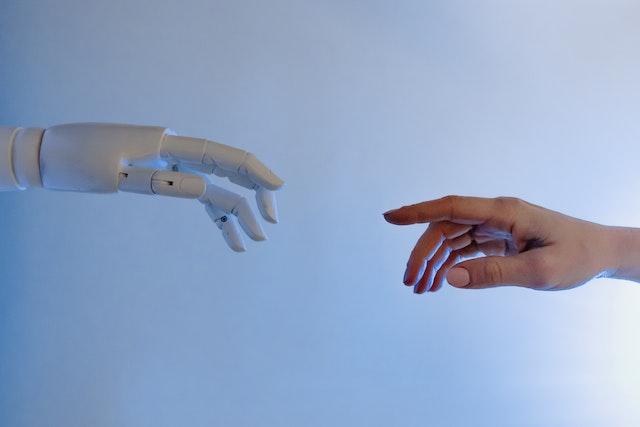

The world is going through the fourth industrial revolution, which causes technology to be integrated into every aspect of our lives.

As a consequence, companies have seen how their traditional Financial Department is evolving towards a Finance Function 4.0.

In this new paradigm, purely transactional work is done automatically. Employees are freed up to perform tasks that computers cannot do, such as making strategic decisions.

The Finance Function 4.0 provides an approach with greater capacity for strategic communication, through the integration of cutting-edge technologies such as IoT, AI, Blockchain, RPA and innovative visualisation tools such as EPM-Jedox, which improve the execution of repetitive tasks and facilitate data-driven decision making.

Here are four key ideas to understand Finance 4.0:

1. Eliminates the routine

It means the end of repetitive and transactional work for employees. They see how their ability to add value to the company increases.

2. Added value

Professionals spend more time analysing the data to make better strategic decisions.

3. Sustainable growth

Financial work is used to generate sustainable growth over time and is no longer seen as an ancillary value to the company.

4. Accessible knowledge

Finance 4.0 automates processes, but also makes them more accessible and intuitive, so that any professional or department can use the information produced.

Recommended article | Interview with Héctor Badal (Yeeply) – How to take advantage of Digital Transformation in the post Covid-19

The active role of the CFO in the Finance Function 4.0

Achieving and exceeding objectives will continue to be key, but the Finance 4.0 approach has important nuances when determining if it is working properly.

In addition to quantitative measurements, there must be financial professionals who have control over the data, but who are also capable of getting involved at different levels, actively contributing to the creation of value for the company.

Within the role of the CFO in Digital Transformation, these professionals must take into account the metrics obtained by other departments. An example would be the NPS or customer satisfaction scores, in order to have a more realistic view of the results obtained.

Therefore not only is it necessary to provide real-time financial information for the optimal performance of the Finance Function, but visualisation tools must also allow for easy evaluation of the large amount of data generated for decision making.

In short, for the Finance Function 4.0 to work properly, it requires daily optimization and process automation work by your finance professionals.

How the CFO of a company can help the Finance Function 4.0

Technology allows us to free ourselves from repetitive tasks and gain productivity and efficiency. However, as we become more agile, the processes become more difficult to understand.

This is where the CFO’s role must acquire a clear focus of all processes. If you are not clear about where we are going, it is very difficult to set the right path.

For the implementation of the Finance Function to be successful, it is essential that the CFO knows the tools to implement and be able to simplify processes as much as possible.

It is not enough to implement technological tools, you have to know what for and why. If this task is done correctly, you will make the information generated accessible to anyone who needs to use it.

You can never forget that information, no matter how useful it may be, will not make decisions for us. Data is an immense source of knowledge, but the CFO must know both its possibilities and its limitations in order to make good decisions.

Therefore, to be a good CFO you have to be able to face the new challenges that digital transformation implies in your department. Technical skills are no longer enough; they must add creativity and an ability to see the big picture to their list of skills.

Related article | What is an Enterprise Performance Management (EPM) solution for companies?

The 4 advantages of the Finance Function 4.0 for business

These are the 4 advantages that the Finance Function 4.0 brings to any type of company:

1. It reduces costs and increases efficiency

The software for finances helps to complete administration tasks such as payroll, invoicing, account management, etc. These automations help reduce costs by 40-75%, but also allow employees to focus on high-value tasks, thus increasing the efficiency of the company.

2. Improve the customer experience

Finance teams work with customers to send them billing communications, payment collection, and more.

Manual shipping methods may result in duplicate shipments or charges. This does not happen with automations, thus improving the customer experience and at the same time improving the brand image.

3. Increase competitive advantage

A strong balance sheet is the goal every CFO wants to achieve. Achieving this goal is made easier through automation and data analytics. It becomes easier to plan, forecast metrics and consequently improve competitive advantage.

4. Create more satisfied employees

Free your staff from the most mundane paper tasks, speeding up and facilitating their work using the tools of Finance Function 4.0.

How to achieve Finance Function 4.0

Any company can incorporate an action plan to achieve the transformation and embrace Finance Function 4.0.

To achieve this, you must follow 3 essential guidelines:

1. Finance as a driver of business change

You will need to position finance beyond the traditional role of profits. You should see them as a driver of change for the organisation.

Performing an initial analysis is key to determining new operating models that add value.

The new models and processes that are integrated must be accessible and understandable to anyone who may need their data generated.

2. Generate data in the Finance Department

The role of the Financial Director is to make sure that all decisions in the company are driven by the analysis of data obtained through the Finance Department.

Let’s not forget that the human experience is capable of building relationships and value models from data that it relates in an interdepartmental way.

3. Invest in digital technologies and tools

Make a commitment to your Transformation Plan.

There should be a concrete investment in automation and other digital tools, but you should also train your finance professionals to leverage the new models and systems for the benefit of the business.

Read more | Accelerating the Digital Company: the Great Challenges for Digital Finance

Yeeply helps companies achieve Transformation 4.0

If you want to integrate Financial Transformation into your company, at Yeeply we can help you.

We put at your disposal technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), Blockchain, Robotic Process Automation (RPA) or innovative visualisation tools in the Finance Funcion 4.0 such as EPM – Jedox so that you can benefit from all the advantages of Transformation 4.0.